PREVENT PENALTIES &

Reduce Reputational Risk

With reduced capture errors & fast trade reporting, you don’t have to lose sleep over penalties & reputational risk.

Reduce integration risks through automated trade reporting.

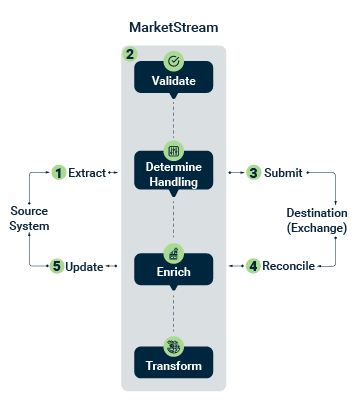

Introducing MarketStream, a Synthesis product that automates your market-facing reporting & integration through straight-through processing (STP).

MarketStream:

Fixed Income (Bonds & Repos)

Equity Derivatives

Agricultural Derivatives

Currency Derivatives

Interest Rate Derivatives

With reduced capture errors & fast trade reporting, you don’t have to lose sleep over penalties & reputational risk.

MarketStream is updated with new market changes so you never miss a beat leading to fines.

Now, your team doesn’t have to waste time on menial tasks.

Automated trade reporting & reduced errors allow your trade reporting capacity to increase significantly so your business can scale.

Why develop integrations internally, when we have years of experience doing just that.

MarketStream uses Straight Through Processing (STP) to reduce the risk of errors, double capture & lengthy reporting.

1. Data is extracted from the source system.

2. The data is processed in MarketStream

3. The data is submitted to the exchange

4. The data is reconciled

5. The data is updated into the source system

MarketTech is a division of Synthesis.

For over 20 years, we have helped leading banks and financial institutions in South Africa to automate their trade synchronisation processes and their internal trade/ risk management systems, eliminating the need for double capture.

This leads to better and faster trade reporting and fewer manual capture errors.

We believe you should focus on what matters – business – while we focus on your seamless integration.

The banking sector isn’t just evolving — it’s being rebuilt from the inside out. And companies like Synthesis are laying

The banking sector isn’t just evolving — it’s being rebuilt from the inside out. And companies like Synthesis are laying

In an era, where digital transformation is reshaping every facet of the financial services industry, Synthesis has emerged as a

In an era, where digital transformation is reshaping every facet of the financial services industry, Synthesis has emerged as a

Real Solutions to Real Problems "We've helped transform businesses across multiple industries by solving their unique integration challenges," explains Matthew

Real Solutions to Real Problems "We've helped transform businesses across multiple industries by solving their unique integration challenges," explains Matthew

Synthesis Software Technologies, a leading South African software development and cloud solutions provider, today announced an exciting new partnership with

Synthesis Software Technologies, a leading South African software development and cloud solutions provider, today announced an exciting new partnership with

Are we still talking about this? Absolutely. Although South Africa has made advances towards moving with innovation and technology, the

Are we still talking about this? Absolutely. Although South Africa has made advances towards moving with innovation and technology, the

See how we partner with our customers to solve problems and create impact with leading technologies.

Your touchpoint on leading-edge technology so you can get your business ahead & keep it there.

Copyright © 2025 Synthesis. All Rights Reserved. Sitemap

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields