Pioneering the Vehicle Tracking and Stolen Vehicle Recovery Company Streamlines Panic Event Classification

- Published

• Digital

• intelligent data

Think Big, Start Small, and Scale Fast with D2E

Consisting of 4 modular workshops, The D2E (Data Driven Everything) program offers multiple entry points for engagement based on the stage of your journey. You can start anywhere. Historically, customers have struggled with their database and analytics transformation and often face challenges such as:

Synthesis D2E program provides a use-case driven framework to help overcome these challenges.

Synthesis partners with your company to accelerate the journey towards becoming data-driven using database, analytics, AI, and ML. Removing barriers to problem-solving with purpose-built solutions and reduced complexity.

New outcomes through digital transformation using database, analytics, AI, and ML are within the reach of all companies. Most enterprises are being mandated by their boards to become “data-driven.”

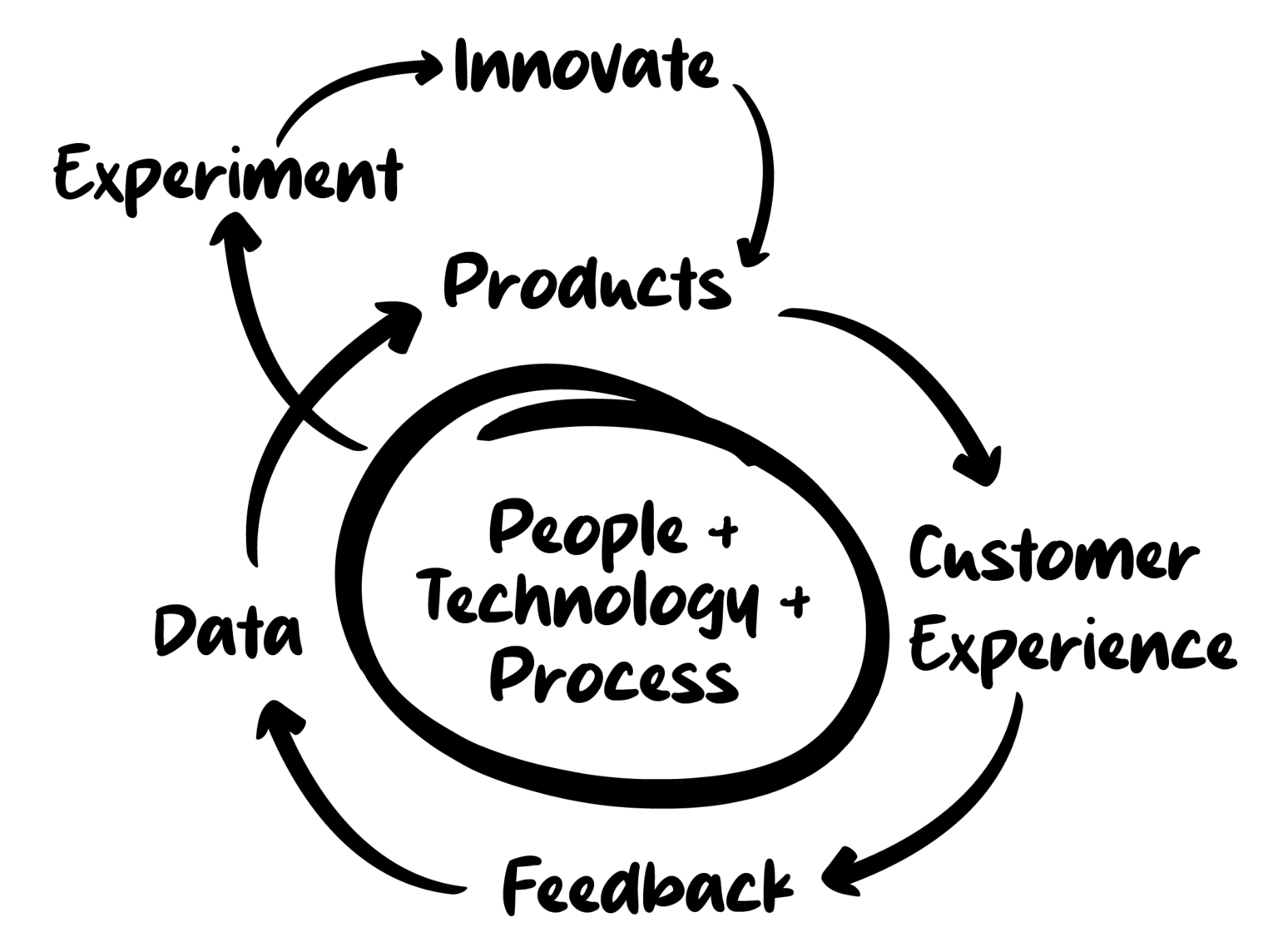

AWS changes the game by removing barriers to problem solving with purpose-built solutions and reduced complexity. With the introduction of the AWS Data-Driven Everything (D2E) program, AWS partners with your company to move faster, with greater precision and a far more ambitious scope to jump-start your own data flywheel.

Ongoing flywheel momentum to INSPIRE, REFLECT, IDEATE, and DEPLOY. Communicate and manage CHANGE at the right place. Get inspired with industry examples, best practices, hands-on demos, and labs. Data is only powerful, when you leverage it to unlock endless new opportunities for your business.

Consisting of 4 modular workshops, The D2E (Data Driven Everything) program offers multiple entry points for engagement based on the stage of your journey. You can start anywhere. Historically, customers have struggled with their database and analytics transformation and often face challenges such as:

Synthesis D2E program provides a use-case driven framework to help overcome

these challenges.

As your partner, Synthesis focuses not only on implementing cutting-edge technology but also on creating a tailored blueprint for your customer service transformation. Our role goes beyond that of a technology provider – we serve as your pit crew in the race to superior customer experience, working tirelessly behind the scenes to help you win.

Align business and senior technology leaders on culture, business priorities, and financial drivers for the data strategy.

Enable your organisation to create a think big vision for data, accelerating value and building experience with a high-priority business use case to turn the data flywheel.

Build the right organisation and process model to support a modern data strategy.

Create a technology foundation that scales with business objectives. At a minimum, this workshop needs to be executed in conjunction with Mindset.

See how we partner with our customers to solve problems and create impact with leading technologies.

Your touchpoint on leading-edge technology so you can get your business ahead & keep it there.

Copyright © 2025 Synthesis. All Rights Reserved. Sitemap

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields