We have crafted solutions for industry leaders, combining years of expertise with agility and innovation.

Synthesis combines RegTech experience and AWS to deliver Compliance Solutions to Standard Bank. Good Governance means adhering to all applicable laws, regulations, policies and procedures. In practice, these processes are often complex and time consuming for employees. Standard Bank’s Compliance division recognised the need to re-engineer its approach to managing employee outside interests, gifts and trading declarations – commonly called “Conflicts and Risk Management solutions”. These solutions are categorised as Know Your Employee (KYE) which assesses an employee’s conduct to identify any conflicts of interest.

Synthesis combines RegTech experience and AWS to deliver Compliance Solutions to Standard Bank. Good Governance means adhering to all applicable laws, regulations, policies and procedures. In practice, these processes are often complex and time consuming for employees. Standard Bank’s Compliance division recognised the need to re-engineer its approach to managing employee outside interests, gifts and trading declarations – commonly called “Conflicts and Risk Management solutions”. These solutions are categorised as Know Your Employee (KYE) which assesses an employee’s conduct to identify any conflicts of interest.

Synthesis created a solution that would allow employees across the Group, to record KYE information in one place – serving as a single source of truth for the organisation. This eliminates the need for separate systems to record, track information and provide a consolidated global view for compliance reporting. A modern application that leverages the power of Amazon Web Services (AWS) was architected to deliver the solution. Using AWS, Synthesis could deliver Big Data, Artificial Intelligence (AI) and Machine Learning (ML) capabilities for the KYE solution. The first phase started with Outside Business Interests (OBI) – a requirement for banking employees to declare any outside banking interests that they held. The next phase will cater for Gifts and Entertainment and Personal Account Trading. Gifts and Entertainment is a process where employees declare all gifts, entertainment, etc. from partners, clients and vendors. Personal Account Trading requires an employee to declare any internal or external share trading activities or over-the-counter assets held.

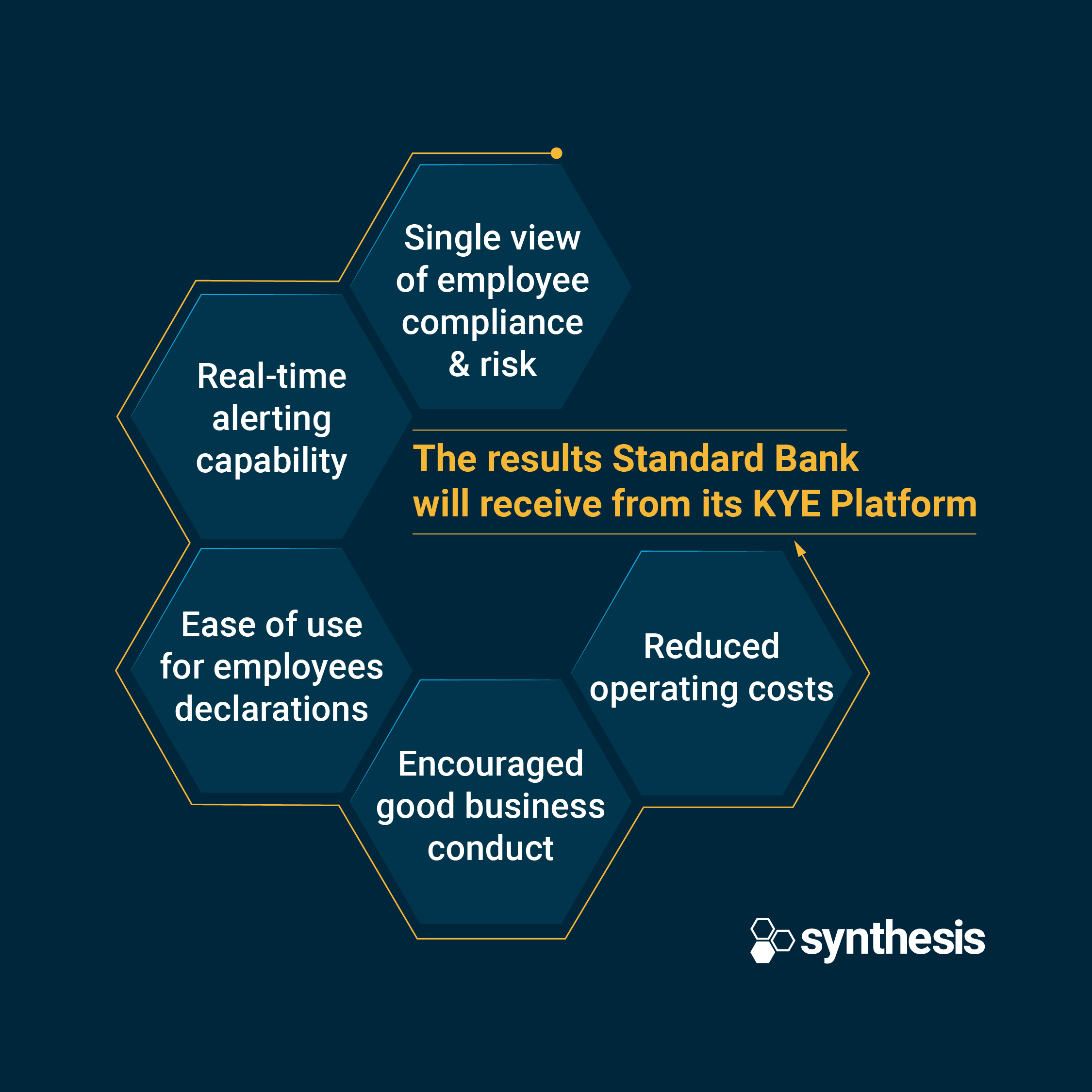

Standard Bank will have a single view of an employee’s compliance and risk. This can also be expanded into real-time alerting capability. Employees can now use a single platform for declarations and provide the necessary information with ease, encouraging and enabling good business conduct. Operating costs will be reduced by replacing multiple, underutilised computing resources with a single, scalable Cloud platform.

Copyright © 2025 Synthesis. All Rights Reserved. Sitemap

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields