Regulatory Reporting Made Simple.

Finally, Balance of Payment (BOP) reporting made simple.

TXstream is the low-effort, high-impact FinSurv solution that streamlines regulatory reporting through seamless integration.

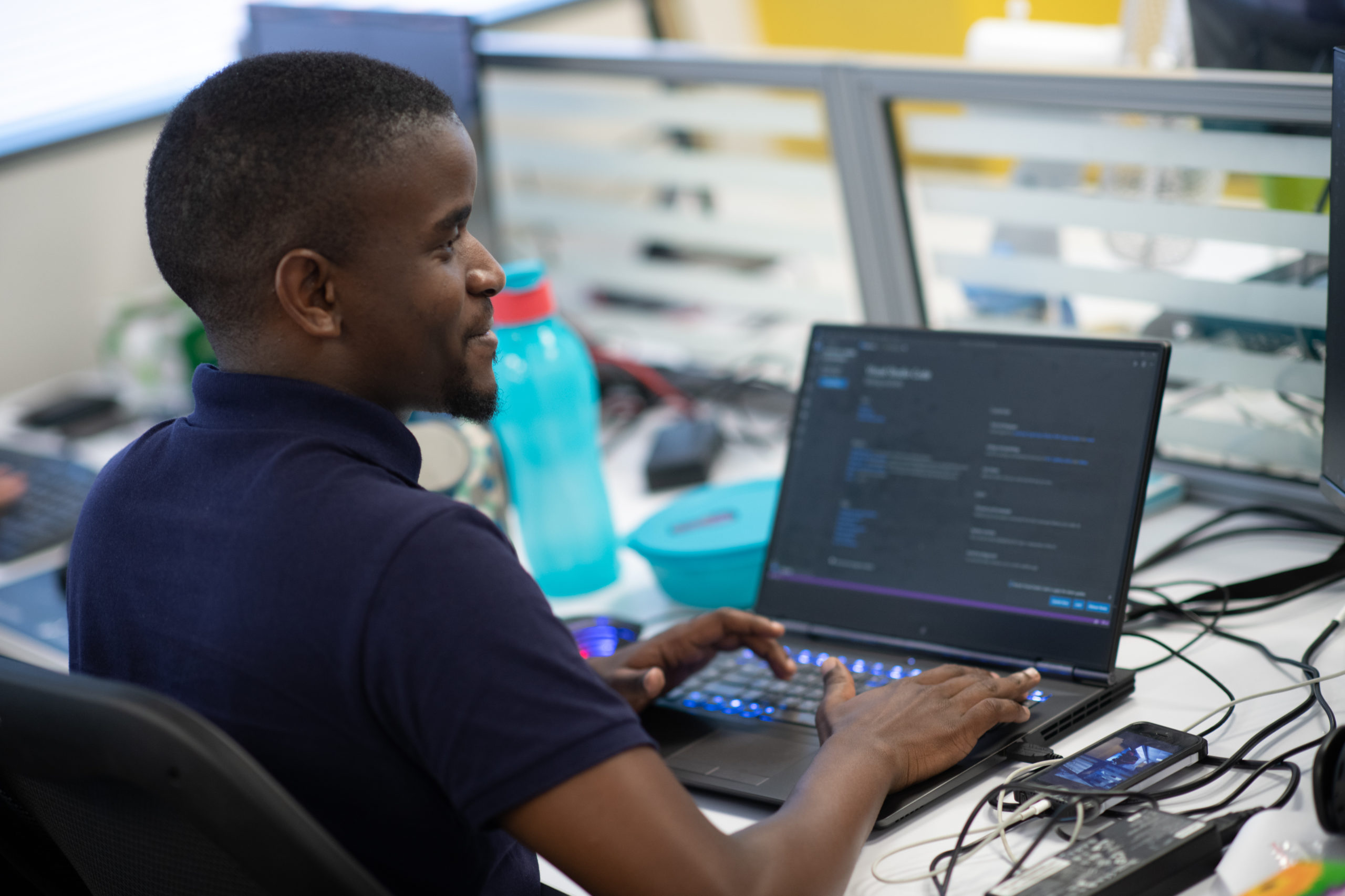

No one likes admin. Especially your customer. Keep it simple.

TXstream Finsurv helps you evaluate exactly what documents you need from your customers with fast validation so you never have to ask twice.

It makes your life simpler as it helps you report correctly and on time.

Say goodbye to missed deadlines and penalties.

TXstream FinSurv uses STP (Straight-Through Processing) and gives you smart tools to evaluate, validate, and monitor transactions.

It includes a centralised rule repository so you can enjoy enterprise-wide compliance with minimal cost and effort.

Multi-Regulator Reporting

Coming Soon

A reporting system that provides all automation and tooling to submit data to BOP3 regulators in compliance with FinSurv. This can be implemented via DEX API or other mechanisms as required.

A services-oriented Architecture that facilitates banking channels and applications with reporting requirements. FinSurv reports can be customised and extended to online or offline utility.

A centralised or decentralised manner of providing FinSurv-compliant validation to all businesses, introducing a centrally-managed way to handle BOP data. Validations may be adapted to suit your needs.

Accurately capture BOP information the first time, with electronic forms completed by your back office or customers. This allows for STP (Straight-Through Processing) to the Regulator.

All Authorised Dealers (AD) and Authorised Dealers with Limited Authority (ADLA) involved with currency conversions or cross-border transactions are required to report to the Regulator. Certain larger corporations may also have a vested interest in managing their own reporting – particularly where large volumes are concerned, such as corporations dealing with Imports and Exports or brokers dealing with pooled investment funds.

An Authorised Dealer is a person authorised by the Financial Surveillance Department to deal in gold or to deal in foreign exchange, for transactions relating to gold and foreign exchange respectively.

Authorised Dealers in foreign exchange with limited authority (ADLAs) are authorised by the Financial Surveillance Department to deal in certain foreign exchange transactions.

The FinSurv suite is made up of applications and components that can be licensed individually or collectively to assist ADs in their operations.

Business Value

The TXstream FinSurv solution covers all the aspects from a regulatory point of view such as validation, reporting and performing duties of the balancing module. We have helped numerous ADs and ADLAs create their reporting blueprints and have guided organisations through the regulator inspection process, audits, and obtain their respective AD or ADLA licenses.

Yes. Components can be licensed separately. Please contact us to investigate your requirements and advise the best solution.

We have two options when it comes to deployment: cloud-based or on-site depending on the size of the institution and whether infrastructure is a concern.

Yes. Synthesis is the leading AWS partner in Africa and our dedicated MSP and Cloud teams are more than capable of providing a suitable, scalable solution for your business needs. Contact us to explore packages and options based on your requirements.

Depending on whether the database and application will reside on the same or different instances, the server requirements may vary.

Single instance for both database and application:

OS: Windows/*nix

CPU: Quad Core or higher (recommended)

RAM: Minimum 8 GB (16 GB recommended)

Hard Drive: Minimum 200 GB Application/Database combined available storage (depending on volume)

Separate instances for database and application:

OS: Windows/*nix

CPU: Dual Core or higher (recommended)

RAM: Minimum 4 GB (8 GB recommended)

Hard Drive: Minimum 100 GB

OS: Windows/*nix or AWS RDS

CPU: Dual Core or higher (recommended)

RAM: Minimum 4 GB (8 GB recommended)

Hard Drive: Minimum 100 GB

* Requirements are dependent on architecture, product selection, and transaction volumes. The above would apply for both Production and DR instances. UAT instance would require minimum specifications stated above.

Depending on the application in the FinSurv Suite, the integration process might vary.

Please contact the FinSurv team to analyse your specific requirements and advise on integration steps. Our team is ready to assist with any integration requirements.

This varies on a case-by-case basis and is typically anywhere between 2 and 10 business days depending on your architecture and requirements.

No. We do, however, have a tiered volume-based pricing model that can be provided on request.

Unlimited. Our license works on a tiered model based on reportable volumes as opposed to number of users. You can have as many users as required.

Yes. Our license fees provide a basic response SLA and support offering. Should you be interested, more advanced SLA options are available.

Optional credit bundles can be added to SLAs for discounted Professional Services. This can be used to cater for ad hoc service requirements.

TXstream FinSurv has been extended to generate the AML/FIC report from data provided, but it is not configured to submit it to the Regulator on your behalf.

For a complete, automated solution that caters for AML/FIC reporting, the RegStream product is available.

See how we partner with our customers to solve problems and create impact with leading technologies.

Your touchpoint on leading technology so you can get your business ahead & keep it there.

Copyright © 2025 Synthesis. All Rights Reserved. Sitemap

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields