We have crafted solutions for industry leaders, combining years of expertise with agility and innovation.

The division within the bank currently makes use of a third-party model development application. This product is currently deployed on a mixture of VM and physical servers on-premises. The product incorporates a variety of components catering to data analytics, regulatory reporting, and data management. This platform is used by the bank to access, manipulate, analyse, and present data in visual formats and reports using a powerful combination of technologies.

The bank has made a strategic decision to pursue technologies hosted on the cloud. They have been on this journey for a few years now and have chosen AWS (Amazon Web Services) as a technology partner due to their comfort levels and understanding of the AWS ecosystem. The application is evolving as well, and the vendor has now provided a new Cloud agnostic version. The bank has identified this as a key business objective to innovate and improve its associated analytical and reporting processes.

Synthesis, being a preferred partner of AWS, was approached to bring in-house skills and expertise to assist in deploying the required infrastructure for the project and work collaboratively with both the bank and their vendor.

The re-platformed version of the application is to be deployed on Kubernetes to provide a robust, highly available, and resilient system in the cloud. This deployment also required several supporting resources. Data storage and access form a large part of the project objectives and the team is looking to move hundreds of terabytes of data into the cloud. AWS Fsx for Lustre will be used for housing the application data due to its high-priority performance, scalability, and throughput that could adjust to the user demand of the platform within seconds. The application requires a high-performance, Linux-based file system to fully enable the application’s analytical and reporting functionality.

Other requirements were to store data in a highly redundant and resilient storage platform that allowed for on-demand access as well as archive storage for older data that was not required to be presented within the application but had to conform to regulatory compliance for financial data.

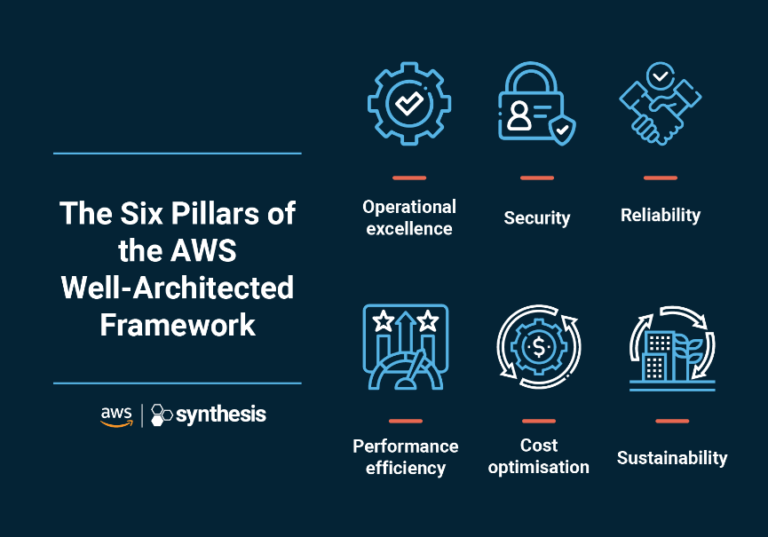

Synthesis advised and assisted the bank in the design and implementation of the infrastructure used to house the application. Conforming to best practices the team has made use of infrastructure as code (IAC) and automation (CI/CD) to provision the environment. The use of managed EKS (Elastic Kubernetes Services) and supporting infrastructure provides a versatile environment that has enabled both the bank and the software vendor to access new horizons in application performance, scalability, resilience, and security. The major focus for the migration, however, was to align the bank more closely to the Well-Architected Framework which covers 6 pillars across Operational Excellence, Security, Reliability, Performance Efficiency, Cost Optimisation, and Sustainability.

The bank has successfully managed to complete the first deployment of the application onto AWS in South Africa. The migration to AWS will enable the bank to operate in a robust, resilient, cost-effective, and highly available environment that allows it to offer faster access to its analytics tools used by hundreds of employees to access both current and historical data and has eliminated the concern around resource constraints experienced in their previous on-premises environment.

As the bank strives to innovate and improve its offerings to clients, its cloud journey is just one step to achieving its goals. This cloud deployment will bring new opportunities to the bank and its staff as well as improve its efficiency in performing its operations.

Ends

For more information on the innovative work Synthesis has done for its clients, contact us on 087 654 3300

About Synthesis

Synthesis uses innovative technology solutions to provide businesses with a competitive edge today. Synthesis focuses on banking and financial institutions, retail, healthcare and telecommunications sectors in South Africa and other emerging markets.

In 2017 Capital Appreciation Limited, a JSE-listed Fintech company, acquired 100 percent of Synthesis. Following the acquisition, Synthesis remains an independent operating entity within the Capital Appreciation Group providing Cloud, Digital, Payments and RegTech services as well as corporate learning solutions through the Synthesis Academy.

Copyright © 2025 Synthesis. All Rights Reserved. Sitemap

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields