[Johannesburg] – 29 November 2022 – South African JSE-listed FinTech group, Capital Appreciation Limited (Capprec), announced its interim results for the six months ended September 2022.

Capital Appreciation generated gross revenues for the six months of R538.1 million (Sept 2022: R439.4 million), an increase of 22.5%, and a stable EBITDA of R138.0 million (Sept 2022: R138.7 million).

Despite substantial additional investment and expenditure in anticipation of increased demand, headline earnings increased by 4.3% to R95.1 million (Sept 2022: R91.2 million). HEPS was 7.76 cents per share (Sept 2022: 7.43 cents an increase on the prior comparable six months of 4.4%).

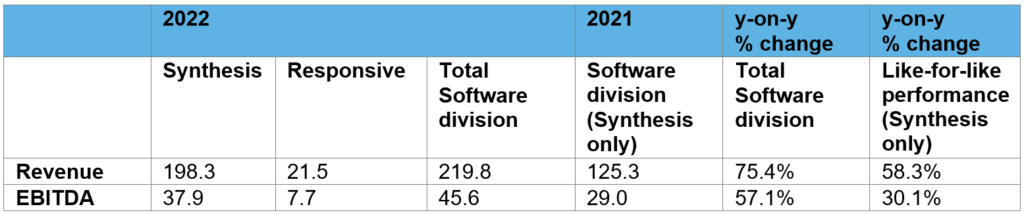

Synthesis Software Technologies and the recently acquired Responsive Group comprise the Software segment of Capital Appreciation.

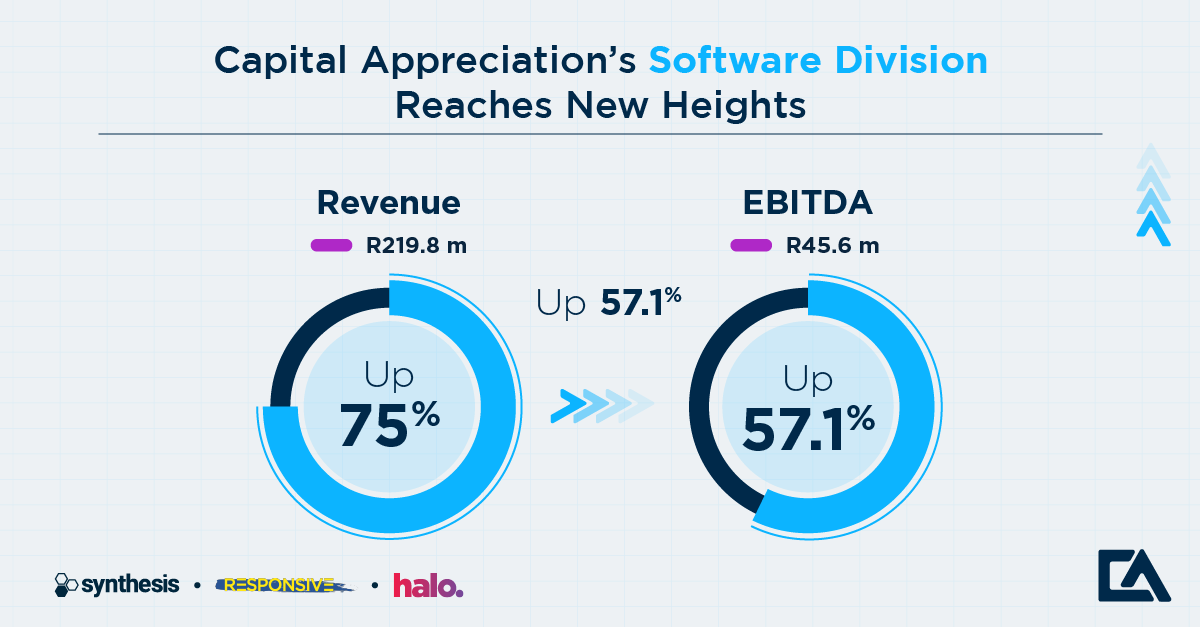

The division generated excellent growth in sales, profits and cash flows, with revenue increasing by 75.4% to R219.8 million (up from R125.3 million the prior year) and EBITDA by 57.1% to R45.6 million (up from R29.0 million in the prior year).

The past six months’ trading was particularly encouraging for the Software division. The investment in and focus on demand generation, brand awareness and skills development have continued to yield significant benefits, attracting new clients, securing new projects and building strong pipelines and multi-year initiatives.

The Synthesis business was a significant contributor to this growth on a stand-alone basis when reviewing the results. It made up 90.2% of the division’s revenues and 83.1% of the profits, with tremendous year-on-year growth.

“Our results demonstrate our unwavering commitment to excellence and to serving our customers through leading technologies. For the past five years, we have continued to achieve superb results. This is due to our vision, passion for pioneering the technology landscape and our proven formula for hiring and developing industry talent. All of this is geared toward solving our customers’ problems and equipping them for the future. I am extremely proud of and grateful to our strong team,” says Michael Shapiro, Synthesis Managing Director.

The Responsive acquisition concluded in March 2022 was successfully integrated into the Software division and is contributing meaningfully. Its financial contribution has been included for the full period for the first time in this set of results for the Software Division.

“Our unique customer-centric digital product approach has given rise to collaborative projects within the Software Division. The synergies that exist are being realised and it is exciting to see promising prospects given the reach and strength of an aligned offering. The Responsive team has delivered consistent high-quality work for clients and we are proud of our teams,” says Marsh Middleton, Responsive Co-founder and Director.

The comparative contribution is as follows:

The Software division previously indicated that, as of 31 March 2022, new business efforts had garnered relationships with a large group of new customers and attracted more than R300 million of contracted sales, for which the revenues would continue to flow through in the 2023 and following financial years.

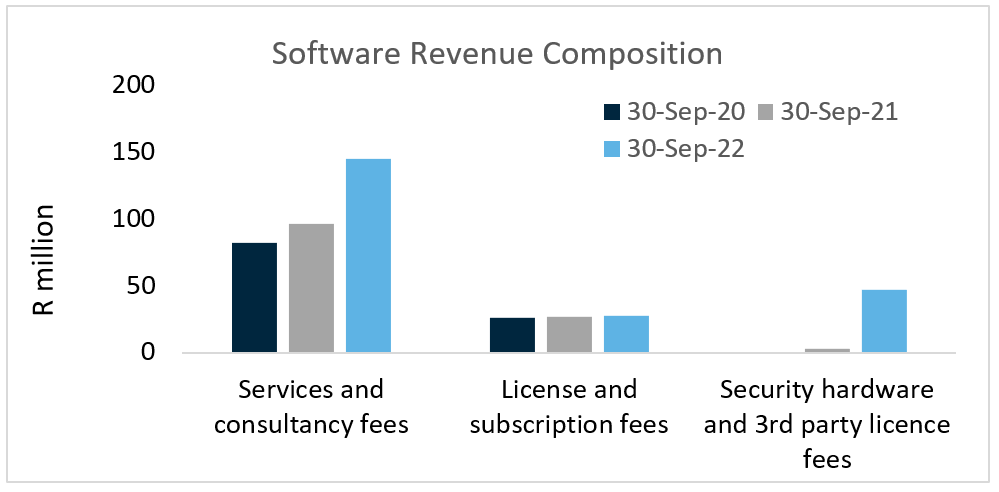

Security hardware and third-party license fees increased from a low of R2.7 million to R47.2 million year-on-year. While third-party products are a lucrative source of additional revenue and create an opportunity to source associated software services and fees, they attract lower margins and therefore tend to dilute margins at a consolidated level. However, it is pleasing to confirm that Software’s core Cloud, RegTech, Intelligent Data and Digital activities’ gross and operating margins have remained consistent while still achieving substantial year-on-year growth in these parts of the business.

Demand for Cloud and Digital services continues to accelerate, as evident in the 51% growth in revenue in these areas (29% excluding Responsive).

The Responsive teams strong design, user interface (UI) and user experience (UX) capabilities as well as development expertise, complement Synthesis’ Digital offering. Collaboration between Synthesis and Responsive is progressing as expected as the joint teams add significant value to our customers.

In recent years, the Software division has sought to diversify its customer base and the portfolio of partners and software products and services that it supports. In the current period, the business was again successful in winning business from new clients in the financial services, retail and telecommunications sectors. The division produced solid geographic diversification, with over 28% of the revenue being derived from international sources.

“The Software division’s pipeline is strong and we anticipate continued growth in demand. Our consistent investment in growth in the Software division is showing an encouraging return on investment,” concludes Brad Sacks, Capital Appreciation Joint Chief Executive.

Going forward, the Software division will continue its investment in skills, international expansion and Halo Dot which is showing positive results to date.

Capital Appreciation declared a dividend of 4.25 cents per share for the period and is cautiously optimistic regarding the future trading periods.

Ends

For more information on the innovative work Synthesis has done for its blue-chip clients, contact:

Kim Furman

Marketing Manager

072 236 3572

About Synthesis

Synthesis uses innovative technology solutions to provide businesses with a competitive edge today. Synthesis focuses on banking and financial institutions, retail, healthcare and telecommunications sectors in South Africa and other emerging markets.

In 2017 Capital Appreciation Limited, a JSE-listed Fintech company, acquired 100 percent of Synthesis. Following the acquisition, Synthesis remains an independent operating entity within the Capital Appreciation Group providing Cloud, Digital and RegTech services as well as corporate learning solutions through the Synthesis Academy.

About Responsive

Responsive is a digital product and solution development agency. It creates web and mobile products powered by design thinking, backed by research and built with the best technology.

The team consists of creative problem solvers and innovators, leveraging design thinking to put customers at the centre and using best-of-breed technology to expertly build and launch products.

Responsive is uniquely positioned and offers a diverse and powerful set of skills to execute end-to-end with excellence.

In 2021 Capital Appreciation Limited, a JSE-listed Fintech company, acquired 100 percent of Responsive. Following the acquisition, Responsive remains an independent operating entity within the Capital Appreciation Group

About Halo

Halo Dot provides innovative software solutions that allow anyone to accept contactless payments directly on their mobile phone. Halo Dot has offices in Amsterdam, Johannesburg, and Cape Town.

Halo Dot was created and incubated by Synthesis. Synthesis and Halo Dot are part of Capital Appreciation Group.