[Johannesburg] – 2 June 2022 – South African JSE-listed FinTech group, Capital Appreciation Limited (Capprec), announced its annual results for the year ended 31 March 2022.

It has experienced a strong acceleration in business activity in the past year and a substantial demand for its innovative technology products and solutions. The Group increased gross revenues for the period by 34% to R831 million.

Synthesis Software Technologies and the Responsive Group comprises the Software segment of Capital Appreciation.

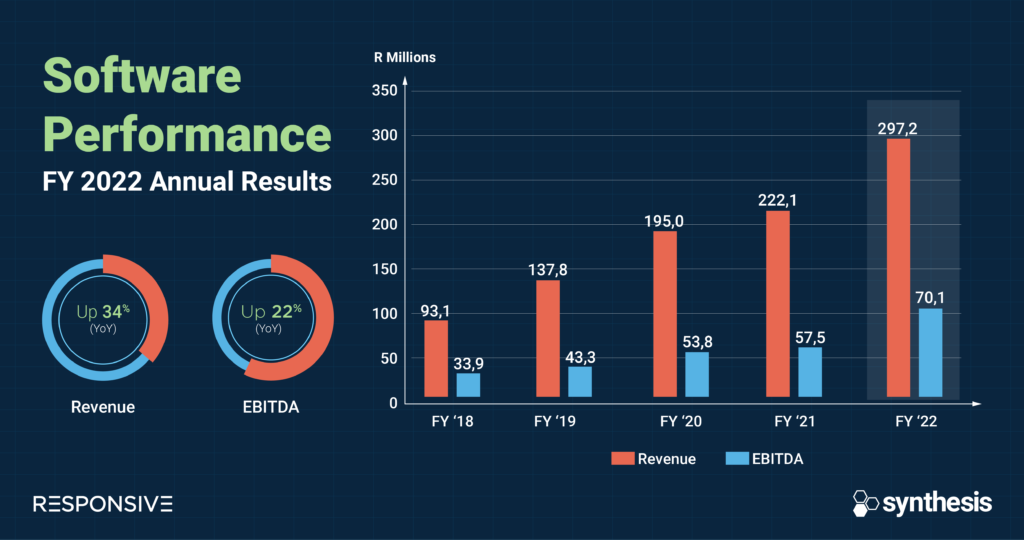

The Software division increased revenue by 34% to R297.2 million, given a strong demand for cloud and digital projects and Hardware Security Modules (HSM) sales that increased threefold. EBITDA increased by 22% to R70.1 million.

Synthesis, a leading software development company was acquired by Capital Appreciation in 2017. This year’s annual results mark its fifth year of being part of a JSE-listed company and its fifth year of substantial growth.

“Looking back over the past five years, it is pleasing to note that we have delivered strong results during a flux of changes. Regardless of the circumstances, we never waned in our commitment to our customers, employees, partners and investors.

We unrelentingly and passionately pursue leading technology solutions to solve problems because businesses want and deserve to be at the summit of the digital landscape today. It’s this passion that shines through in our results,” says Michael Shapiro, Synthesis Managing Director.

During this period, Synthesis received the award of AWS Consultancy Partner of the Year for Sub-Saharan Africa and achieved the milestone of over 200 AWS certifications. This further cemented its leadership position for enterprise clients requiring a secure and rapid migration to the AWS Cloud.

The company saw significant expansion and contracted with new customers in financial services, telecoms, retail, healthcare services and contact centres.

Synthesis laid a solid foundation for international expansion with international revenue up by 33% in Asia Pacific, USA and the UK. Diversified revenue streams were also achieved through a focus on new vertical sectors, including logistics and healthcare.

Halo Dot, the Visa, Mastercard and AMEX tap-on-phone payment technology created by Synthesis furthered this diversification. The technology has generated strong interest from local and international markets, attracting multiple new customers. This innovative solution is becoming universally adopted as a novel method to accept card payments on an Android device without the need for purchasing additional hardware.

Synthesis saw expansion with Capital Appreciation launching Synthesis Labs B.V. in Amsterdam to further capitalise on international opportunities.

Synthesis is set to continue its strong momentum. It concluded new contracts with a value of more than R300 million, a large portion of which will be recognised in FY 2023.

The acquisition of the Responsive Group became effective on 1 March 2022 and has already been integrated into the Software division. Responsive is a digital solutions Group that designs and develops digital applications for clients in South Africa, the USA, Europe and the United Kingdom. The synergies between Synthesis and Responsive will provide clients with a comprehensive digital strategy, design and execution capability from the Group.

“We are excited, motivated and anticipate another positive year as we continue to invest in our people and emerging technologies,” says Shapiro.

Ends

For more information on the innovative work Synthesis has done for its blue-chip clients, contact:

Kim Furman

Marketing Manager

072 236 3572

About Synthesis

Synthesis uses innovative technology solutions to provide businesses with a competitive edge today. Synthesis focuses on banking and financial institutions, retail, healthcare and telecommunications sectors in South Africa and other emerging markets.

In 2017 Capital Appreciation Limited, a JSE-listed Fintech company, acquired 100 percent of Synthesis. Following the acquisition, Synthesis remains an independent operating entity within the Capital Appreciation Group providing Cloud, Digital and RegTech services as well as corporate learning solutions through the Synthesis Academy.